Normally professional tax in not applicable all over the country but there are some state where the government take professional tax

Karnataka,

Bihar,

West Bengal,

AndhraPradesh,

Telangana,

Maharashtra,

Tamil Nadu,

Gujarat,

Assam,

Kerala,

Meghalaya,

Odisha,

Tripura,

Madhya Pradesh

Sikkim.

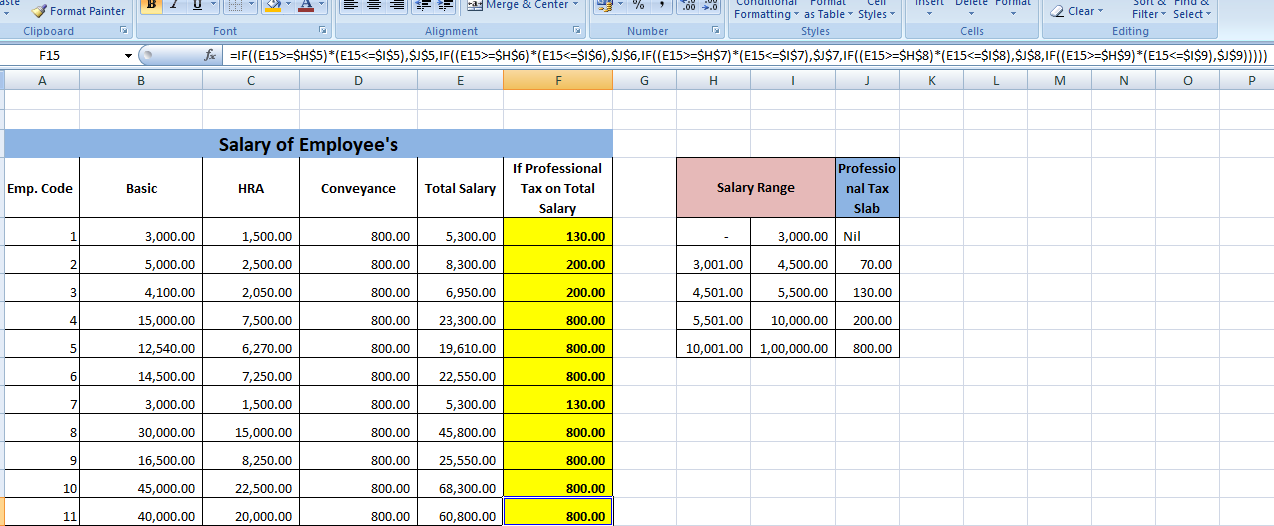

Professional tax caluclted on two basis 1. Professional Tax on Total Salary.

2. Professional Tax on Basis Salary.

So Here is the Exanple

Formula: =IF((E7>=$A$2)*(E7<=$B$2),$C$2,IF((E7>=$A$3)*(E7<=$B$3),$C$3,IF((E7>=$A$4)*(E7<=$B$4),$C$4,IF((E7>=$A$5)*(E7<=$B$5),$C$5,IF((E7>=$A$6)*(E7<=$B$6),$C$6)))))

($ it is the sign that fix the cell, select the cell and press F4 or Fn+F4)

Karnataka,

Bihar,

West Bengal,

AndhraPradesh,

Telangana,

Maharashtra,

Tamil Nadu,

Gujarat,

Assam,

Kerala,

Meghalaya,

Odisha,

Tripura,

Madhya Pradesh

Sikkim.

Professional tax caluclted on two basis 1. Professional Tax on Total Salary.

2. Professional Tax on Basis Salary.

So Here is the Exanple

Formula: =IF((E7>=$A$2)*(E7<=$B$2),$C$2,IF((E7>=$A$3)*(E7<=$B$3),$C$3,IF((E7>=$A$4)*(E7<=$B$4),$C$4,IF((E7>=$A$5)*(E7<=$B$5),$C$5,IF((E7>=$A$6)*(E7<=$B$6),$C$6)))))

($ it is the sign that fix the cell, select the cell and press F4 or Fn+F4)

2. Calculation of professional Tax according to the basis salary

No comments:

Post a Comment

Thank you for comment.